Insider Brief:

- SpeQtral and Thales Alenia Space have entered a new phase of collaboration to demonstrate entangled photon transmission between space and Earth, advancing the foundations of quantum communication beyond QKD.

- The planned demonstration will validate key technologies, including free-space optical links and environmental signal analysis—relevant for future quantum networks, from secure communications to distributed computing.

- Governments and companies worldwide are accelerating investment in quantum communication infrastructure, but the landscape remains fragmented across technical maturity and strategic alignment.

- Space Insider helps public and commercial stakeholders navigate this complexity by tracking company activity, funding, partnerships, and readiness across the quantum-space value chain.

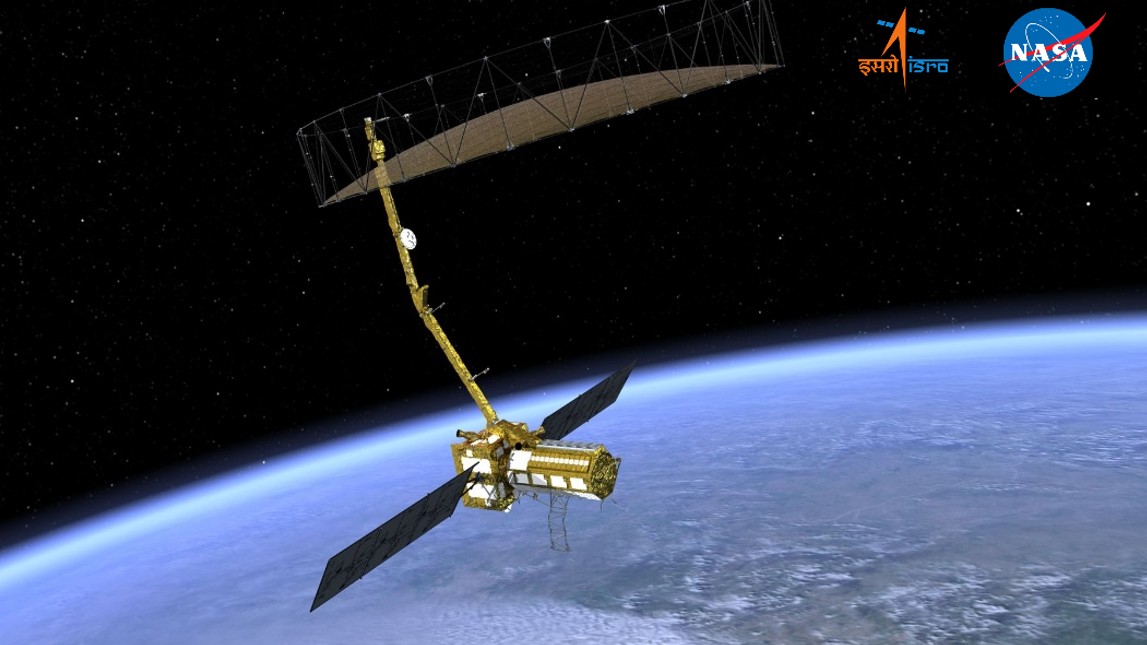

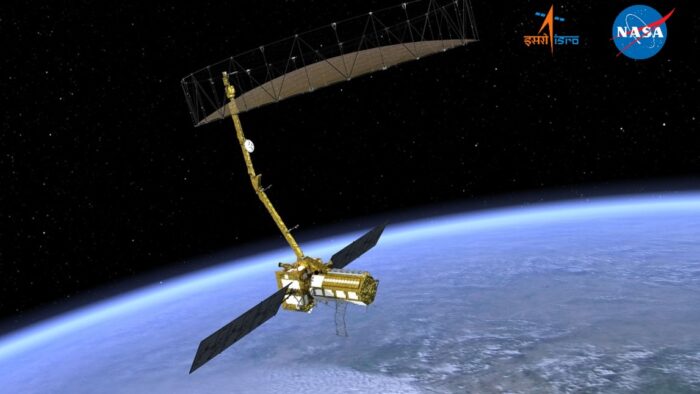

Quantum communications, often confined to laboratory demonstrations and fiber-based terrestrial trials, are entering their orbital phase. In a recent announcement from SpeQtral and Thales Alenia Space, the two companies extend their partnership to develop and test a space-to-ground quantum communication link. This includes a planned joint demonstration of a space-to-ground quantum link, integrating SpeQtral’s in-development quantum satellite with Thales’s first quantum ground station, which includes environmental sensors designed to measure how real-world atmospheric conditions affect quantum signal fidelity.

This partnership reflects a broader industrial strategy around enabling quantum communications at scale, not just through quantum key distribution (QKD), but by laying the groundwork for a future quantum internet. The planned demonstration involves testing the transmission of entangled photons between space and Earth, a foundational capability for a wide range of applications including distributed quantum computing, quantum sensing, and secure synchronization protocols.

While SpeQtral’s near-term commercial model is centered on space-based QKD, the technologies being validated, including entangled photon links, free-space optical channels, and environmental signal analysis, support the longer-term ambition of globally interconnected quantum information networks. These networks will allow quantum computers, sensors, and nodes to communicate securely and coherently across continents, extending the reach of quantum protocols far beyond terrestrial infrastructure.

What Is Quantum Communication — and Why Space?

Quantum communication uses the principles of quantum mechanics, especially entanglement and superposition, to transmit information in ways that are inherently secure. One of the most well-known applications is QKD, where encryption keys are shared using quantum states that, if observed or tampered with, alert both parties to an intrusion attempt.

This is intended for immunity from interception, including concerns around the future potential of quantum computers that are capable of breaking today’s public-key cryptosystems.

There are two main approaches to quantum key distribution: terrestrial and satellite-based. Both use the quantum properties of particles, typically photons, to transmit encryption keys that are secure by design. The difference is in how far those keys can be shared.

Terrestrial QKD uses fiber optic cables. While it works well over short distances, quantum signals weaken quickly due to scattering and absorption in the fiber. This limits practical range to a few hundred kilometers unless trusted nodes are used to relay the signal.

Space-based QKD sends photons through space, where signal loss is naturally much lower. This allows secure key exchange over thousands of kilometers and makes it possible to connect distant ground stations, which is an essential step toward a global quantum communication network.

SpeQtral’s quantum satellite and Thales’s quantum ground station are being developed to support the experimental validation of free-space quantum communication links, with a focus on entangled photon transmission between space and Earth. While this capability is necessary for quantum key distribution, it is also a foundational step toward broader quantum network applications, such as distributed quantum computing, precision time transfer, and the long-term vision of a global quantum internet.

Environmental Complexity Meets Quantum Fragility

While space reduces signal loss compared to fiber, it introduces other challenges, including temperature variation, atmospheric turbulence, and signal distortion as photons pass back through the atmosphere. To better understand and mitigate these effects, Thales Alenia Space is equipping its quantum ground station with environmental sensors that monitor local conditions and their impact on signal quality. These measurements will inform system calibration and help define the performance boundaries for future large-scale deployments.

This pairing of quantum optics and real-time environmental data is a hallmark of next-generation ground segment design. It suggests that the future of satellite quantum communication isn’t just about getting photons from point A to point B, but about managing the fidelity and resilience of that signal across changing conditions.

From Demo to Market: Mapping the Emerging Quantum Space Economy

The SpeQtral–Thales Alenia Space partnership reflects a broader trend of quantum entering the space domain. Numerous companies globally are now developing quantum payloads, photon sources, entangled photon pair emitters, quantum repeaters, and secure network architectures. As evidenced by a recent report from Space Insider on QKD, governments from Canada to the EU and China are actively investing in quantum-secure communication and orbital infrastructure.

But the market remains fragmented. Players operate at different levels of maturity, with diverging technical roadmaps and uncertain deployment timelines. For decision-makers across public and commercial sectors, understanding who is building what, and how close they are to operational readiness, is a growing challenge.

According to Space Insider’s QKD market analysis, the space-based QKD vendor market alone is projected to reach a cumulative value of $4.5B by 2030, growing from $0.5B in 2025 to $1.1B at a CAGR of 16%. This includes system integrators, ground station upgrades, terminal retrofits, and quantum interface development. Within that, QKD satellite vendors account for $3.7B of the projected value, reflecting the growing demand for payload and integration capabilities.

Yet vendor-side activity only tells part of the story. On the end-user side, the QKD market is projected to reach $3.5B annually by 2030, with a cumulative revenue opportunity of $9.3B over the 2025–2030 period. Government and diplomatic customers are expected to drive over 60% of this demand, particularly in the early years, as commercial uptake lags behind infrastructure rollout.

At Space Insider, we provide the tools and context to navigate this complexity.

Our platform maps real-time company activity, tracks partnership signals, and identifies which firms are actively advancing space-based QKD. Users can explore the underlying technologies these companies are developing, see how much funding they’ve secured, and assess where investment and innovation are converging.

Through our advisory services, we support agencies, OEMs, and integrators with tailored insight into market size, supply chain readiness, technology benchmarking, and procurement strategy. Whether shaping policy, scouting suppliers, or building go-to-market roadmaps, our intelligence helps clarify the commercial and strategic landscape.

Where Quantum in Space Stands and What Comes Next

The move toward space-based quantum communication reflects an evolving set of priorities around data security, national infrastructure, and global interoperability. As quantum technologies mature, space becomes an increasingly strategic domain.

Still, the move from demonstration to commercial deployment is nontrivial. The ecosystem is populated by a mix of early-stage ventures, established aerospace firms, and publicly funded initiatives, all operating on different timelines and technical baselines. As stakeholders push forward, the ability to understand who is building what, how, and with whom will be essential.

To explore the full market map and QKD insights, request access to our latest report or get a limited view of the platform here.

Cierra Choucair

Cierra Choucair is a journalist and data analyst at Space Insider, where she covers emerging technologies and the frontier edges of deep tech, including space. With a background that blends scientific analysis, strategic communication, and product storytelling, she translates technical complexity into actionable insight across research, startups, and policy.

Share this article: