There’s no denying the space domain has become central to global defence and security. Nations increasingly rely on satellites for communications, intelligence, and navigation. Meanwhile, new threats—from anti-satellite weapons to cyberattacks—are forcing governments to re-examine their approaches to policy, procurement, and partnerships with commercial space technology companies.

Today’s commercial space ecosystem offers fast innovation cycles, alternative methods of launching payloads, and the agility that traditional government procurement often lacks. Consequently, stakeholders across Europe, the United States, and beyond are looking to space as a vital frontier where defence and security strategies meet commercial innovation.

The Rising Importance of Space in Security

In recent testimony, US Chief of Space Operations Gen. Chance Saltzman expressed concern that current national security space policies are “lagging in the importance of establishing declaratory policy,” stating that “I just feel like we’re lagging in the importance of establishing declaratory policy … and establishing the kind of policies we need to move fast.” He underscored a familiar frustration that “space has been a little bit out of sight, out of mind … so it just hasn’t risen to the level where serious policy considerations need to be.” Such constraints leave the US Space Force petitioning “very high levels of approval” even for routine operational tasks. Saltzman noted: “We do that all in simulation, not in actual live practice.” Ultimately, he raises concerns about how critical space has become and how unprepared current frameworks can be.

European policymakers hold parallel concerns. According to The European Space Policy Institute’s (ESPI) recent report, Rising Together? The (Re)Convergence of Europe’s Space and Defence Industries, Europe’s public space budgets still devote a relatively small percentage to military space, even as “the space industry has been called on to deliver on more and more contracts aiming to support security and defence missions.” The report points out that “the space industry is a precondition for a serious security & defence policy” and highlights how Europe underinvests in these capabilities compared to the United States.

Europe’s Changing Industrial Landscape

Europe has a long-standing civil space heritage, but policymakers have begun to incorporate security and defence objectives into space strategies. Collaboration often takes place through shared frameworks—the European Space Agency (ESA), the European Defence Fund (EDF), and specialized multilateral programs. A growing percentage of contracts involve Earth observation for surveillance or secure communications for military users. Established firms like Thales Alenia Space, Airbus Defence and Space, OHB, and others, frequently win these contracts, but governments are also seeking partnerships with newer companies that bring fresh technologies and flexible, agile operations to the table.

At the national level, countries like France, Italy, Germany, and the UK are spearheading military-focused space activities. They contract for remote sensing, satellite-based intelligence, advanced radar, and space surveillance. According to ESPI’s research, France and the UK lead in awarding security and defence contracts to domestic space companies, while smaller nations leverage multinational frameworks such as ESA or EU programs.

Yet many policymakers emphasize the dangers of fragmented industrial approaches. Several national strategies cite the need to pool industrial strengths across borders, reduce reliance on external suppliers, and forge deeper connections between civil and defence research. They also note that government budgets alone cannot address the complexities of space-based security; private-sector partners must share both the risks and rewards.

Commercial Space, Dual-Use Innovation, and Civil-Military Synergy

A recent podcast from Seraphim’s “Generation Space” titled, Global Defence and Security: The Critical Importance of Rapid Access to Space, shed light on how commercial space providers can meet national security demands faster than legacy procurement structures. Winnie Lai, CEO of Auriga Space, remarked, “Space is now the new strategic high ground … from a global economic standpoint, we cannot afford to lose access to these satellites.” She pointed to adversarial capabilities—particularly “anti-satellite” weapons from China and Russia—that threaten space-based assets. In her words, these systems “have been able to get up close to allied satellites, shadowing them … Some may have jamming and destructive laser capabilities.”

Investors, too, are responding to this heightened threat environment. Rob Desborough, Managing Partner at Seraphim Space, noted that “at last count, over 80% of the companies in the Seraphim portfolio…would consider themselves to be dual-use technologies,” citing Earth observation, on-orbit servicing, and advanced satellite communications as prime examples.

Space capabilities rarely exist in a purely military silo. Even “defence-specific” satellites often rely on commercial manufacturers, private ground stations, or partnerships with civil agencies. Earth-observation constellations, for instance, might monitor forest fires and farmland in peacetime yet provide critical intelligence during conflicts.

ESPI’s report noted how civil and military R&D “feed each other,” creating opportunities for “dual-by-default” systems that fluidly transition between commercial and defence applications. This synergy not only unlocks cost-sharing benefits for governments but also expands revenue opportunities for industry. Analysts thus see an imperative for deeper collaboration to address urgent security challenges in orbit, especially as commercial players can rapidly replenish satellites or deploy new capabilities under short timelines—far quicker than traditional state-run processes.

Mounting Threats: Rapid Militarization and Anti-Satellite Capabilities

From both European and US perspectives, anti-satellite weapons, or ASATs, are a major concern. General Saltzman—alongside other defence officials—warned of China’s expanding efforts to develop destructive or disruptive weapons that could disable US and allied satellites. Space is not only a resource for national security; it is also, in Saltzman’s words, “a war-fighting domain.” Protecting satellites means establishing resilient architectures and developing both ground- and space-based means to safeguard vital space assets.

In Europe, ESPI research confirms that “only pooling all European expertise and resources” can help match the growing space capabilities of major powers, emphasizing that fragmented national efforts are no longer sufficient. Military leaders and analysts stress the importance of a unified approach across institutions such as the European Defence Agency, ESA, NATO, and private industry. This entails both new doctrinal thinking and higher spending levels, ensuring that satellite architecture, cybersecurity measures, and space situational awareness remain fully aligned with evolving threats.

Concurrently, there is a push for frameworks that enable forces to train with both offensive and defensive space capabilities. Traditionally, European militaries have focused on land, sea, and air domains, but the accelerating contestation of Earth’s orbit demands doctrines that treat space as a primary theatre. ESPI’s report advocates for dedicated simulation platforms, live exercises (within legal confines), and cross-border collaboration to develop tactics that protect assets such as communications and remote-sensing satellites, while also preparing for scenarios in which adversarial systems may need to be disabled or degraded.

Commercial Landscape: Recent Funding Rounds and Notable Defence Contracts

Rising Space Defence Companies With Fresh Capital

Several space companies with defence solutions have attracted substantial funding in the past year, underscoring market confidence in dual-use technologies that address governmental and commercial applications alike.

Anduril’s $1.5 billion Series F

Anduril Industries took center stage in Q3 of 2024 with a $1.5 billion Series F round. Largely driving the quarter’s 64% year-over-year increase in total space tech investments, according to Space Insider reports, Anduril’s valuation soared to $14 billion. While best known for advanced defence systems and autonomous technologies, Anduril also plays an active role in the space sector through its Lattice platform, enhancing the Space Surveillance Network by integrating data from multiple sensors.

Aetherflux’s $50 Million Series A

Aetherflux is a California startup aiming to beam solar power from space, backed by the US Department of Defense (DoD). The company’s technology could reduce the need for vulnerable supply lines in contested regions. The company’s recently closed $50 million Series A, along with government funding, exemplifies the Pentagon’s growing interest in resilient, space-based power solutions.

Urban Sky’s $30 Million Series B

Specializing in stratospheric platforms for dual-use intelligence, Urban Sky secured $30 million in a Series B round to support a wider range of commercial and defense applications, including search and rescue operations, environmental monitoring, and disaster response. Already collaborating with NASA and the U.S. Army, the firm envisions “persistent data collection” at altitudes above 60,000 feet—an approach that can fill gaps between airborne and orbital missions.

Portal Space Systems’ Oversubscribed USD 17.5 Million Seed Round

Portal Space Systems recently closed an oversubscribed $17.5 million seed round to accelerate Supernova, a multi-role spacecraft engineered for contested and congested space environments. This design aims to achieve performance on par with nuclear thermal propulsion—without the regulatory hurdles of an onboard reactor. Focused on both commercial and defence applications, Supernova provides ultra-high delta-v for rapid orbital shifts, up to five years of operational lifetime, and flexible payload integrations.

These recent successful financing rounds highlight a robust investor appetite for advanced capabilities in orbit—particularly those addressing manoeuvrability, power, and autonomy for military as well as civil needs.

Space Companies Winning Major Security & Defence Deals

Commercial players are seeing accelerating demand for satellite imagery, on-orbit solutions, and advanced ground infrastructure. Several deals reflect governments’ intent to diversify suppliers and harness cutting-edge commercial innovation:

SpaceX’s Evolving Role in U.S. Defence and Security Missions

SpaceX remains a dominant player in U.S. defence contracts, reportedly securing $1.8 billion in 2024 under the National Security Space Launch program and a $733 million contract in October 2024 for satellite launches. Recent modifications to NASA’s Launch Services II contract added Starship as a launch vehicle option, further broadening SpaceX’s role in federal missions. However, many have highlighted possible conflicts of interest tied to Elon Musk’s political ties and financial support for the Trump administration, coupled with some SpaceX employees reportedly holding advisory roles in federal agencies. Critics argue these relationships pose ethical risks and note that oversight mechanisms ensuring contract fairness have been weakened recently.

BAE Systems’ USD 151 Million Space Force Contract

BAE Systems recently landed a $151 million award to advance the U.S. Space Force’s Future Operationally Resilient Ground Evolution (FORGE) Command and Control (C2) system. The next phase seeks to bolster missile warning and tracking capabilities. BAE Systems will spearhead development of a prototype that integrates commercial and government off-the-shelf tech to ensure improved agility and responsiveness. Awarded through the Space Enterprise Consortium, the FORGE C2 initiative highlights a continuing push toward open, scalable ground systems.

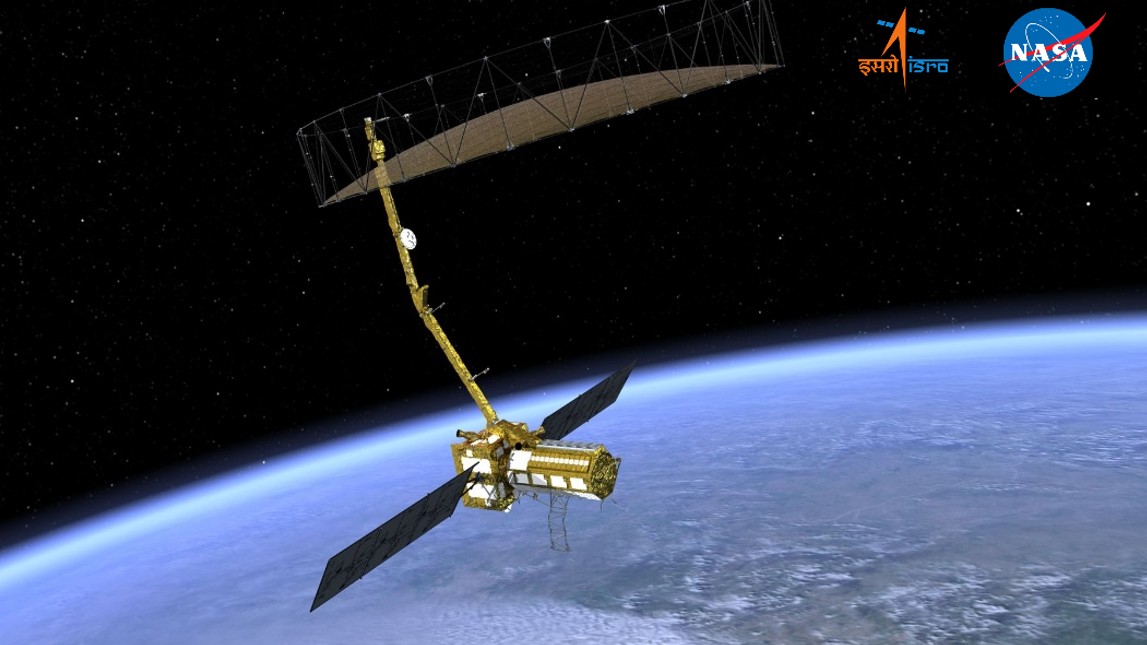

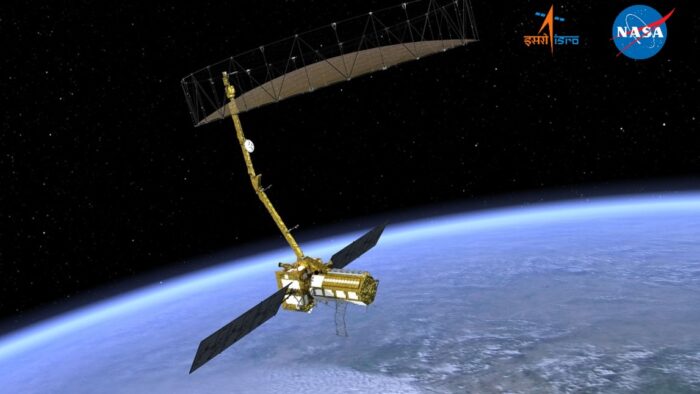

ICEYE’s Partnership With NATO SITCEN

Finnish synthetic aperture radar specialist ICEYE recently announced it will provide SAR satellite data to NATO’s Situation Centre (SITCEN). This first-of-its-kind deal between NATO HQ and ICEYE grants alliance decision-makers deeper insights into ground conditions, object detection, and 24/7 weather-independent monitoring. ICEYE’s rapid growth into the defence sector has been underscored by multiple satellite deliveries to NATO-friendly nations, demonstrating the strategic value of high-resolution SAR data.

Maxar’s €13.6 Million Geospatial Contract With the Netherlands MoD

The Netherlands Ministry of Defence inked a four-year deal worth €13.6 million to access Maxar’s Geospatial Platform (MGP) Pro. Leveraging Maxar’s extensive imagery archive and AI-driven analytics, the Netherlands’ Defence Geographic Agency gains on-demand imagery and 3D modeling. This capability is vital for modern operations, enabling real-time intelligence and improved planning across land, sea, and air domains.

Collectively, these agreements reveal a growing emphasis on advanced remote sensing, secure ground stations, and integrated C2 architectures. Traditional defence primes remain crucial players, but agile commercial innovators are increasingly winning bids for specialized services such as high-res imaging and Earth-observation analytics. The result is a more diverse supplier base, with public agencies actively sourcing from both longtime stalwarts and commercial newcomers.

Future Outlook: Competition, Cooperation, and Rapid Scaling

Defence and security leaders increasingly regard space as an enabler and operational theatre. Growth in anti-satellite capabilities, heightened rivalry in orbit, and the persistent reliance on satellites for economic and military functions make the space tech industry indispensable. Europe’s shift toward deeper integration of space and defence echoes the United States’ own calls to reform restrictive policies and allocate more robust funding.

Commercial firms, meanwhile, demonstrate that they can often build and launch new space systems faster than traditional pipelines. As a result, they are becoming central to how governments reimagine security in orbit. Industry players who master responsive launch, robust satellite manufacturing, advanced on-orbit servicing, or cutting-edge data analytics will likely be at the forefront of this evolving landscape.

Finally, many agree that policy must keep pace. Political declarations about space as a “war-fighting domain” mean little if militaries cannot quickly adapt procurement rules, classification protocols, and training practices. Governments that collaborate effectively with commercial innovators stand to benefit from stronger, more resilient space architectures. For all stakeholders, the message is clear: space is not only the new high ground; it is now a primary arena for ensuring global defence and security.

Alyssa Lafleur

Alyssa Lafleur has over 10 years of experience working as a tech and science communicator in industries spanning public health, health informatics, life sciences innovation, cybersecurity, and space tech. Alyssa brings a wealth of knowledge in developing and managing communication strategies that drive value for highly technical industries with thought leadership, community outreach, and brand awareness.

Share this article: