Insider Brief:

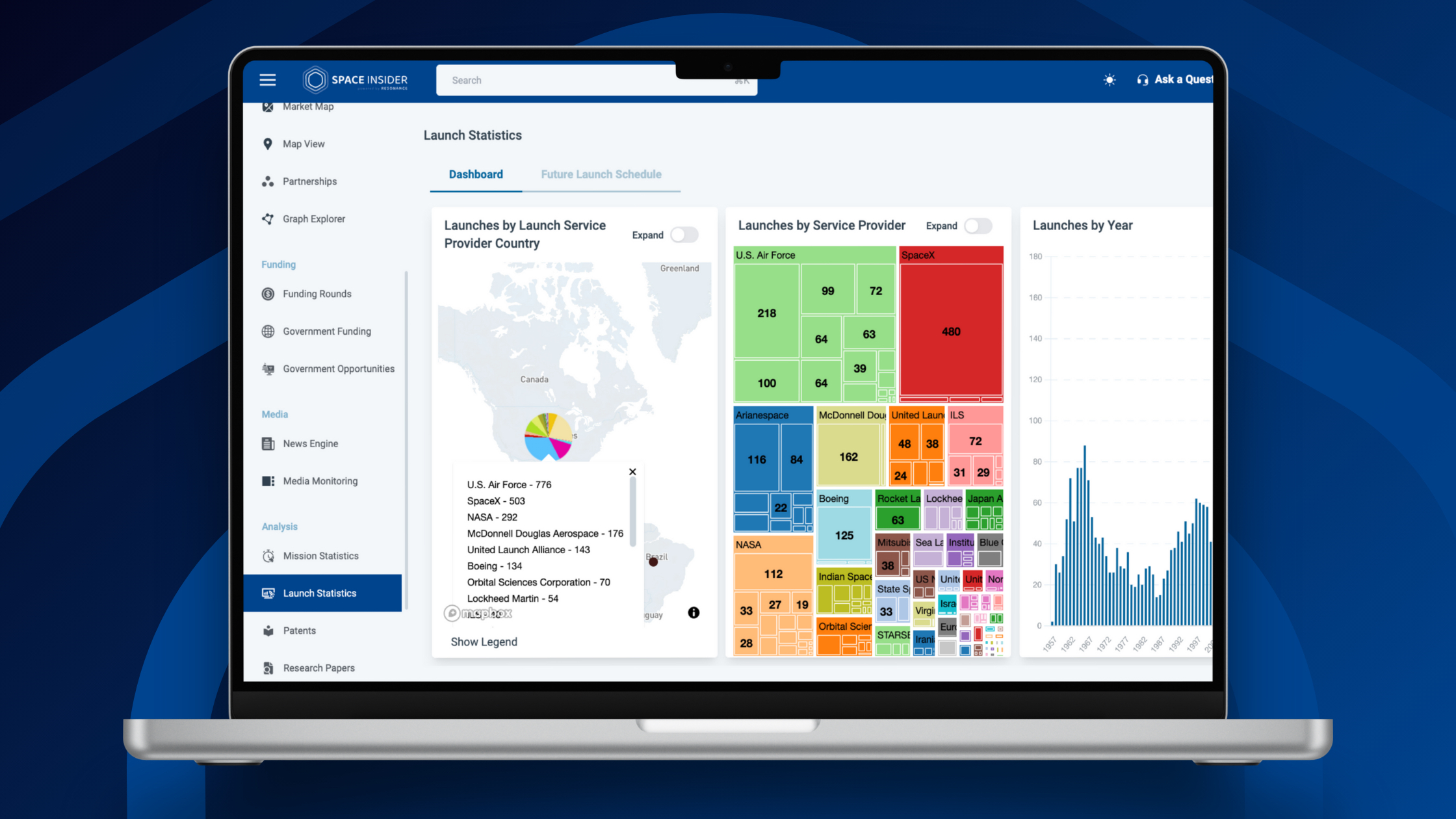

- Space Insider equips decision-makers with daily-updated, structured intelligence across the global space economy, integrating company data, funding, IP, and government procurement into one enterprise-grade platform.

- The platform’s proprietary taxonomy and graph explorer reveal hidden relationships between spacecraft owners, operators, manufacturers, and investors, enabling deeper strategic analysis beyond static databases.

- Its newest feature, Mission Statistics, provides historical and forward-looking data on global spacecraft missions, linking each to associated organizations to support targeting, benchmarking, and procurement decisions.

- Strategy, business development, and policy teams use Space Insider to anticipate competitor moves, identify opportunities, and make informed choices based on real-time insights across missions, technology, and funding landscapes.

In a sector defined by technical complexity, long planning horizons, and global interdependence, decision-makers in space cannot afford fragmented intelligence. Strategic missteps, whether in procurement, investment, partnerships, or expansion, often result not from lack of ambition, but from lack of clarity.

Space Insider was built to solve this. Powered by the Resonance Intelligence Engine, Space Insider delivers real-time, structured insights across the global space economy by integrating live data, expert validation, and relational mapping to illuminate what’s happening, who’s involved, and where the momentum is building.

More than a static database, Space Insider is a live, enterprise-grade platform updated daily and designed for strategy leads, business development executives, policymakers, and analysts who need a panoramic, actionable view of the global space industry. From funding rounds to launch calendars, the platform delivers continuously refreshed intelligence to keep pace with a dynamic domain.

Platform Overview: Designed for Industry Professionals

Space Insider combines breadth and depth across the global space ecosystem, tracking companies, investors, and public agencies, with data updated daily and structured into an actionable and interactive intelligence model.

Core Platform Capabilities

- Custom Taxonomy & Graph Explorer: Every entity is classified using a proprietary taxonomy, enabling detailed segmentation by capability, geography, funding, space heritage and more. The platform’s graph explorer connects spacecraft owners, operators, manufacturers, launch providers, and funding sources which reveal ecosystem relationships that static spreadsheets and conventional intelligence platforms miss.

- Entity Profiles: Each company, agency, or investor has a structured profile including classifications, space heritage, funding M&A activity, patents and research papers, and relational context giving you both the facts and the strategic positioning.

- Global Government Opportunity Tracking: Space Insider aggregates procurement activity from a wide range of North American and European sources, helping vendors stay on top of the space ecosystem with the latest in data and intelligence, as well as streamlining their visibility to access opportunities and potential business growth.

- Research & IP Intelligence: The platform includes access to over 26 million patents and over 9000 space-related research papers, indexed by the technology tags associated with relevant companies. This enables users to explore innovation trends, R&D focus areas, and intellectual property landscapes within the context of the broader ecosystem.

- Advanced Search Engine: Space Insider includes a proprietary search engine purpose-built for the space economy to surface real-time, market-moving signals from curated trusted sources. Users can customize a live intelligence feed around specific interest areas such as contract awards, funding activity, research, and more.

This integrated architecture allows teams to move from signal to strategy without switching tools or validating data across disparate sources.

Mission Statistics: Closing the Loop on Mission Intelligence

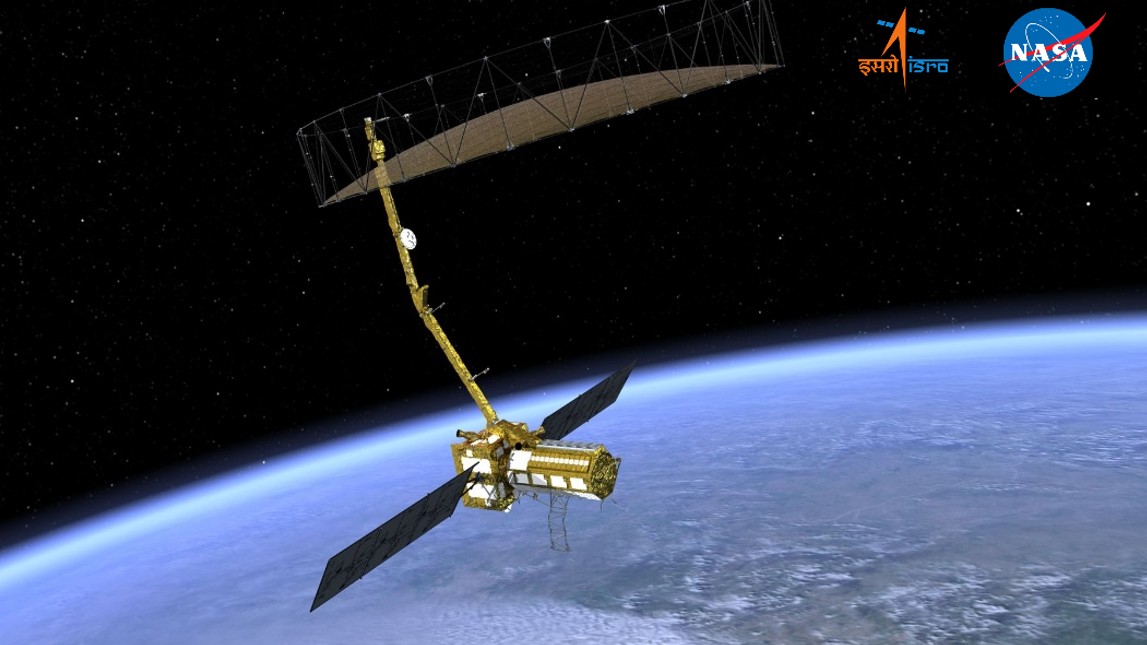

Mission Statistics, the newest capability in Space Insider, delivers structured, filterable, and relational data on spacecraft missions, launch activity, and participation history spanning from the early days of the first orbital missions through confirmed future launches into the 2040s.

This feature connects missions to the organizations that owned, built, launched, and operated them, creating a continuous intelligence loop from launch to legacy.

What It Offers

- Historical Mission Archive: Full visibility into decades of global spacecraft launches, filterable by spacecraft name, year, mission segment, spacecraft status, sector, mass category, system integrator, system integrator country, spacecraft operator country, and spacecraft owner country.

- Future Launch Schedule: A forward-looking dataset of confirmed missions through 2042, enabling early engagement, forecasting, and procurement preparation.

- Company Space Heritage: Automatically generated histories of company involvement in missions, allowing users to assess experience, specialization, and reliability across segments and timeframes.

- Launch Statistics: Complete breakdowns of orbital and suborbital launch activity by provider, vehicle, geography, and success status.

Strategic Applications

For business development teams, Mission Statistics enables precise targeting by revealing which organizations have historically built or operated payloads and provides forward-looking visibility into upcoming launches based on announced missions, including spacecraft names and associated launch providers. Strategy teams can benchmark competitors by number, type, and status of missions. Procurement officers can assess supplier reliability by launch performance over time. Market analysts can track macro-level trends in activity by segment, geography, or vehicle type.

Most notably, Mission Statistics is not an isolated dataset. It is fully integrated into the platform’s intelligence, meaning users can see how a spacecraft connects to its manufacturer, launch provider, operator, investors, patents, and funding history all in a single, navigable view.

How Decision-Makers Use Space Insider

- Business Development: Identify prime contractors, subsystem vendors, company contacts, or prospective customers active in relevant mission segments. Spot emerging players or regional trends that can shape go-to-market strategies.

- Corporate Strategy: Evaluate competitors’ footprints, monitor diversification strategies, and anticipate M&A activity based on launch activity and ecosystem positioning.

- Procurement & Policy: Assess supplier capability, reliability, and specialization using historic participation data. Align procurement and investment with long-term industry trajectories and mission outcomes.

- Market Intelligence & Research: Track shifts in launch cadence, technology adoption, and spacecraft applications over time. Combine mission-level data with IP and funding flows to forecast future growth areas.

Strategic Clarity in a Complex Sector

The global space economy is evolving rapidly with new missions, partnerships, and players emerging weekly. But complexity should not mean confusion. Space Insider is the intelligence platform built to meet this moment by providing a singular view across a multi-billion dollar, multi-decade, multi-orbit industry.

With the launch of Mission Statistics, that view is now sharper. From spacecraft builders and launch providers to long-range procurement strategies, Space Insider helps you see not only what is happening but what it means.

Request access to the Space Insider platform and explore how mission-level intelligence can power your next strategic move.

Cierra Choucair

Cierra Choucair is a journalist and data analyst at Space Insider, where she covers emerging technologies and the frontier edges of deep tech, including space. With a background that blends scientific analysis, strategic communication, and product storytelling, she translates technical complexity into actionable insight across research, startups, and policy.

Share this article: