Jeffrey Max has spent three decades turning hard-tech white spaces into operating businesses, steering startups in electronic trading, mobile payments, and additive-manufactured rocket engines to several nine-figure exits while raising more than $850 million in growth capital along the way. His common thread is pragmatic execution: identify a market bottleneck, assemble partners who already excel at the missing pieces, and move quickly from concept to revenue. Now, as chief executive of Magna Petra Corp., Max is applying that playbook to an isotope that could reshape both the global energy mix and the deep-tech stack behind quantum computing.

That isotope, helium-3, is rare on Earth—measured in just tens of kilograms per year—but plentiful in the Moon’s surface dust after eons of solar-wind bombardment. It carries strong potential as a clean-fusion fuel, and its cryogenic properties already underpin ultra-low-temperature quantum processors, high-definition lung MRI scans, and neutron detectors that police global trade lanes. At roughly $50 million per kilogram, demand is throttled not by interest but by supply.

A new agreement with NASA will give Magna Petra access to flight-qualified hardware for its first lunar prospecting mission. If Max’s phased, partner-heavy plan holds, that hardware could help deliver the first commercially mined lunar commodity back to Earth before the decade ends.

The NASA partnership that de-risks first contact

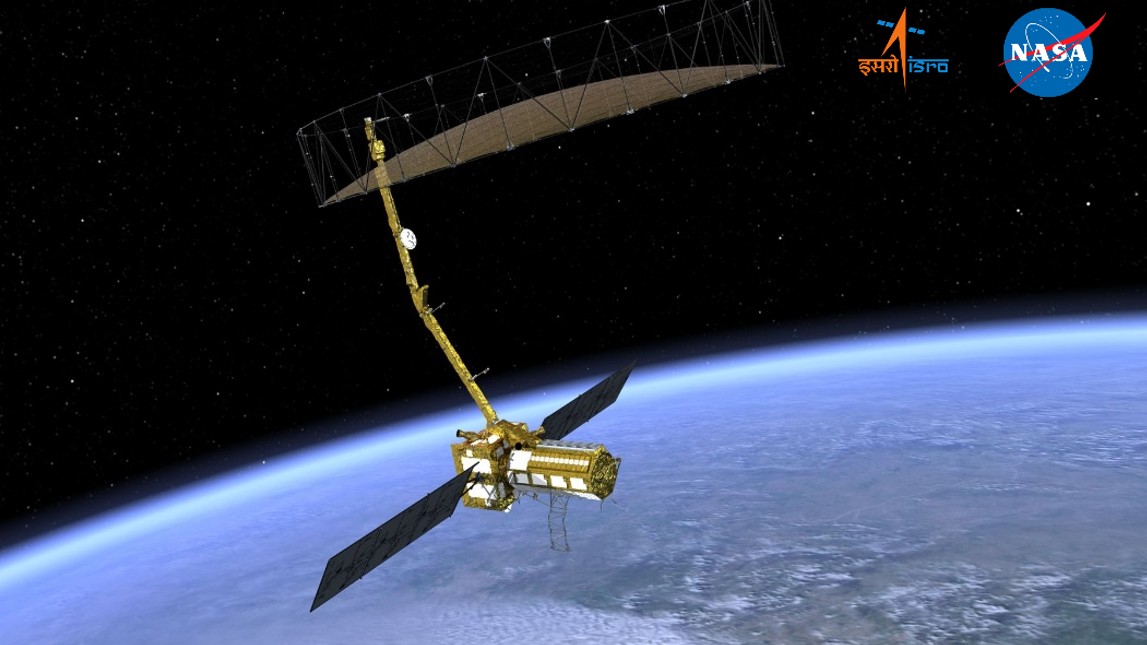

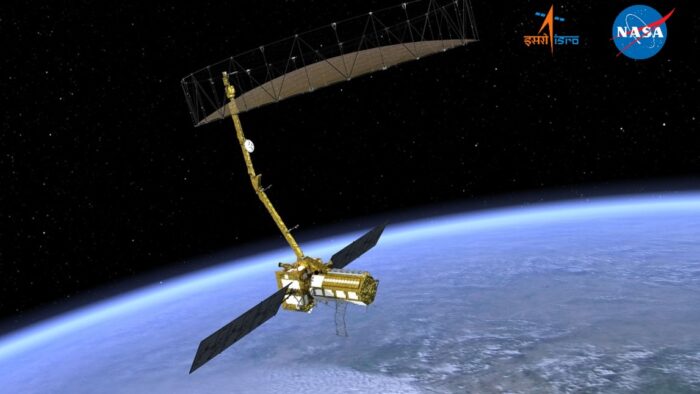

Under a new Cooperative Research and Development Agreement (CRADA) with NASA’s Kennedy Space Center, Magna Petra will field-test the agency’s lunar-hardened Mass Spectrometer Observing Lunar Operations (MSOLO). The instrument—previously flown on government missions—will validate the company’s AI-driven “digital twin” of helium-3 distribution.

“We’re mounting this NASA instrument on a rover… as the rover transits the lunar surface,a rake on the under-side disturbs the regolith, creating plumes of isotopes, and the instrument reads the composition,” Max said. NASA retains a research windfall; Magna Petra avoids years of in-house sensor development. “By combining public-sector ingenuity with private-sector agility, this agreement allows us to ground our science in real-world data,” Max says.

He then widens the lens to explain why the arrangement matters to investors outside the space sector: “We’re an energy/–

A phased, partner-heavy flight plan

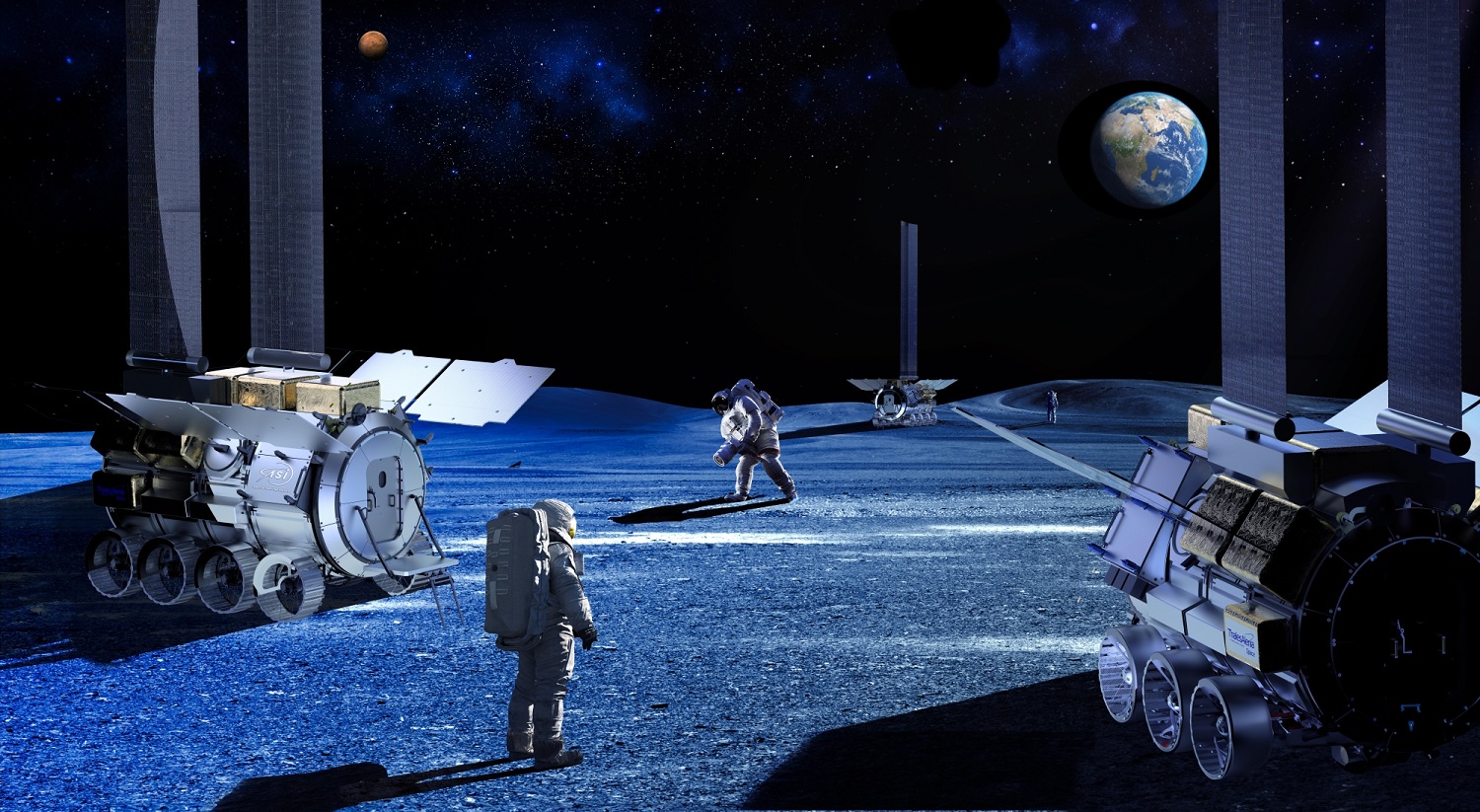

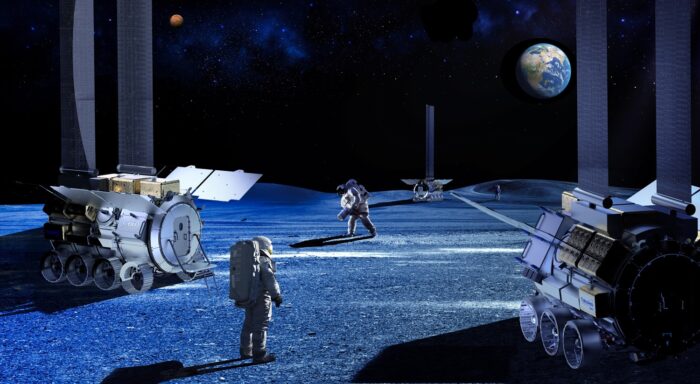

Before Magna Petra can ferry helium-3 to Earth, it has to progress through a disciplined sequence of milestones that balance scientific validation, commercial risk, and capital efficiency. The plan unfolds in five clearly defined phases—each one leveraging specialized partners for launch, transit, instrumentation, or surface operations—so the company can focus squarely on the missing piece: proving and scaling lunar isotope extraction as a viable business.

Digital-twin groundwork (2024 – 2025)

Magna Petra’s first task plays out on the desktop. An in-house AI team refines a “digital twin” of the Moon, ingesting four-and-a-half billion years of solar-wind models, isotope-migration data, and NASA spectral archives. “The model gives us a first-pass map of helium-3 distribution and density,” Jeff Max says, “but ground truth still matters.”

Recon Mission 1 – South-polar prospecting (2027)

The company’s maiden landing will ride to a south-polar site aboard ispace’s Mission 3 lander. A small rover, fitted with NASA’s flight-qualified MSOLO mass spectrometer, will rake the regolith; liberated gas plumes will flow into the instrument for real-time analysis. “We’re literally shaking loose the dust and reading what comes off,” Max explains, noting that polar regions combine long solar-wind exposure with permanently shadowed cold traps.

Recon Mission 2 – Equatorial validation (2027/8)

A second mission, scheduled for 2027/8 on ispace’s next flight, repeats the experiment at an equatorial location. Comparing data from two widely separated latitudes will confirm—or correct—the digital-twin predictions. “If the model nails both sites, confidence leaps for every pixel of that map,” Max says.

Capture-and-return demonstration (2029 – 2030)

With deposits verified, Magna Petra’s next step is a capture-and-return mission. A proprietary low-energy plume-capture device aims to gather tens of kilograms of helium-3, store the gas in pressure vessels, and deliver it to Earth via a sample-return capsule. Max puts the economics bluntly: “A 20-kilogram cargo at today’s prices approaches a billion dollars of revenue against a mid-nine-figure mission cost.”

Industrial scale-up (2031 and beyond)

Success unlocks an industrial phase early in the next decade. Multiple capture units—delivered by commercial landers, serviced by cislunar transports, and operated in parallel—would create a regular commodity pipeline from the lunar surface to Earth. “I’m not reinventing launch or landers,” Max emphasizes. “SpaceX provides launch, and our cislunar partners handle transit. We focus on the part no one else is doing—harvesting the isotope and proving it can pay for itself.”

To execute each phase, Max refuses to reinvent core services others already excel at. “I’m not going to build launch—SpaceX does that fine… If you want to go fast, go alone. If you want to go far, go together.” That ethos extends to cislunar transport (ispace and others), surface mobility (partner discussions with Toyota and others), and sample-return logistics.

Funding realities: space timelines versus venture horizons

Today the world ekes out only 20-60 kilograms of helium-3 per year, distilled from aging nuclear warheads in the United States, Russia, and China. “Helium-3 today on Earth is super expensive… it can sell for as much as $50 million a kilo,” Max noted, a price that throttles broader commercial use. Magna Petra’s business model targets that bottleneck: collect the isotope where it is plentiful and return it to the markets that need it.

Max remains candid about the financial gap between deep-space project cycles and standard venture-capital return windows. He warns that the Venture Capital ecosystem “have effectively become bankers,” seeking three-to-five-year exits that clash with eight-year technology-readiness ladders common in space tech. That mismatch strands many deep-space ventures in what Max calls “the valley of execution”—too capital-intensive for quick software-style returns, yet too commercial to live on grants alone.

Helium-3 extraction offers a rare bridge: a lunar exploration mission with an Earth-side commodity revenue stream, large enough to satisfy investors without perpetual government grants. Because the isotope already commands ≈ US $50 million per kilogram on Earth, a single 20-kilogram return payload could gross about US $1 billion, while Max pegs the demonstration mission at roughly US $230 million—an undeniably attractive margin.

“It’s still exploration,” he notes, “but the economic return lands back on Earth, not in a closed space-only loop”. In other words, helium-3 provides a commodity payoff that arrives early enough to fit within a fund’s second term, effectively bridging the gap that has stalled other lunar-resource concepts such as water or oxygen extraction.

To align incentives across that timeline, Magna Petra relies on three capital channels:

- Strategic hardware contributions: Public agencies provide access to flight-qualified instruments—NASA supplies MSOLO, for example—in exchange for priority access to the new science these devices collect on the Moon.

- Mission-level equity stakes: Long-horizon investors commit capital directly to the demonstration flight and receive a proportional share of any helium-3 revenue that payload generates.

- Partner-aligned investment: Strategic partners are paid in the currency that matters most to them—be it money, mission data, flight heritage, or brand visibility—so long as the mix advances the mission and meets their objectives.

Combined, the model de-risks execution and accommodates investor time horizons: government assets compress early capital needs, strategic partners lower cash burn by supplying proven hardware or services, and the first commercial cargo of helium-3 promises a payday soon enough to satisfy even “banker” VCs—something few other exploration missions can claim

Why Helium-3 Matters—And the Milestones Magna Petra Aims to Hit

Even the most compelling technical promise hinges on two things: a clear value proposition for end-users on Earth and a step-by-step plan that actually delivers product into their hands. Helium-3 checks the first box, offering clean fusion fuel, quantum-grade cryogenics, sharper medical imaging, and better nuclear-contraband detection. Magna Petra’s task is to check the second—moving from verified lunar deposits to kilogram-scale returns and routine deliveries.

Clean power without radioactive waste

Helium-3 fusion converts mass directly to electricity with no long-lived radioactive by-products. “When you fuse two helium-3 molecules … you generate the highest amount of energy per gram of fuel of any source that exists, and you generate zero radioactive waste,” Jeff Max told us. If Magna Petra can ship even a few tens of kilograms per year, grid-scale reactors gain a fuel that sidesteps the disposal and public-acceptance problems that dog deuterium–tritium designs.

The cryogenic backbone for quantum computing

The same isotope boils at 3⁰ K, making it “the only refrigerant that’s been identified for dilutive cooling for quantum data centers.” Quantum processors need millikelvin environments to keep qubits coherent; a reliable lunar supply would remove today’s cost and volume bottleneck, opening the path to industrial-scale quantum clusters.

Sharper images and safer borders

Hospitals already use helium-3 as an inhalant for ultra-high-contrast lung MRI, but scarcity drives prices to roughly US $20 000 per patient scan, limiting deployment. Border agencies face a similar pinch: neutron detectors that “light up if there’s a container … with nuclear material in it” rely on the isotope, yet annual global production hovers between 20 kg and 60 kg. An Earth-bound medical and security market therefore waits for volume, not demand.

A commodity anchor for the lunar economy

Most in-situ resource ideas—water ice, oxygen, construction regolith—carry 20- to 30-year paybacks and depend on government procurement. Max argues that helium-3 is different: it “is an exploration mission that has a commercial hook” because the product returns to Earth and commands billion-dollar cargo values today. That near-term cash flow could seed a broader cislunar logistics network, showing private investors a path to profit before the hotel-on-the-Moon era arrives.

Execution: the only metric that counts

For all the promise, Max keeps the scorecard brutally simple: “It’s only ever about execution … Success looks like success.” For Magna Petra the checkpoints are clear:

- Verified deposits: Reconnaissance rovers must prove the digital-twin maps accurately locate rich regolith pockets.

- Captured kilograms: The 2029–2030 capture-and-return mission needs to “grab it, can it, and bring it back.”

- Delivery and use: True victory arrives only when fusion labs, quantum fabs, hospitals, and port authorities receive isotope they can deploy. “Collection is success number one; delivery and use are success number two.”

If those milestones are met, Magna Petra won’t just have mined the Moon; it will have inserted a critical element into Earth’s clean-energy and advanced-technology supply chains.

Looking Ahead

Magna Petra is betting that disciplined execution, not speculative hype, will anchor the first profitable link between the Moon and Earth’s clean-energy economy. If its timeline holds, the company will deliver a commercial cargo of helium-3 before many terrestrial fusion startups switch on their demonstration plants. Whether Magna Petra or another team crosses the line first, the lesson for the lunar resources field is the same: pair a commodity with existing demand, structure capital around early revenue, and partner for everything else.

Alyssa Lafleur

Alyssa Lafleur has over 10 years of experience working as a tech and science communicator in industries spanning public health, health informatics, life sciences innovation, cybersecurity, and space tech. Alyssa brings a wealth of knowledge in developing and managing communication strategies that drive value for highly technical industries with thought leadership, community outreach, and brand awareness.

Share this article: